ASCENT Education loan Choices Which have Or Rather than An effective COSIGNER

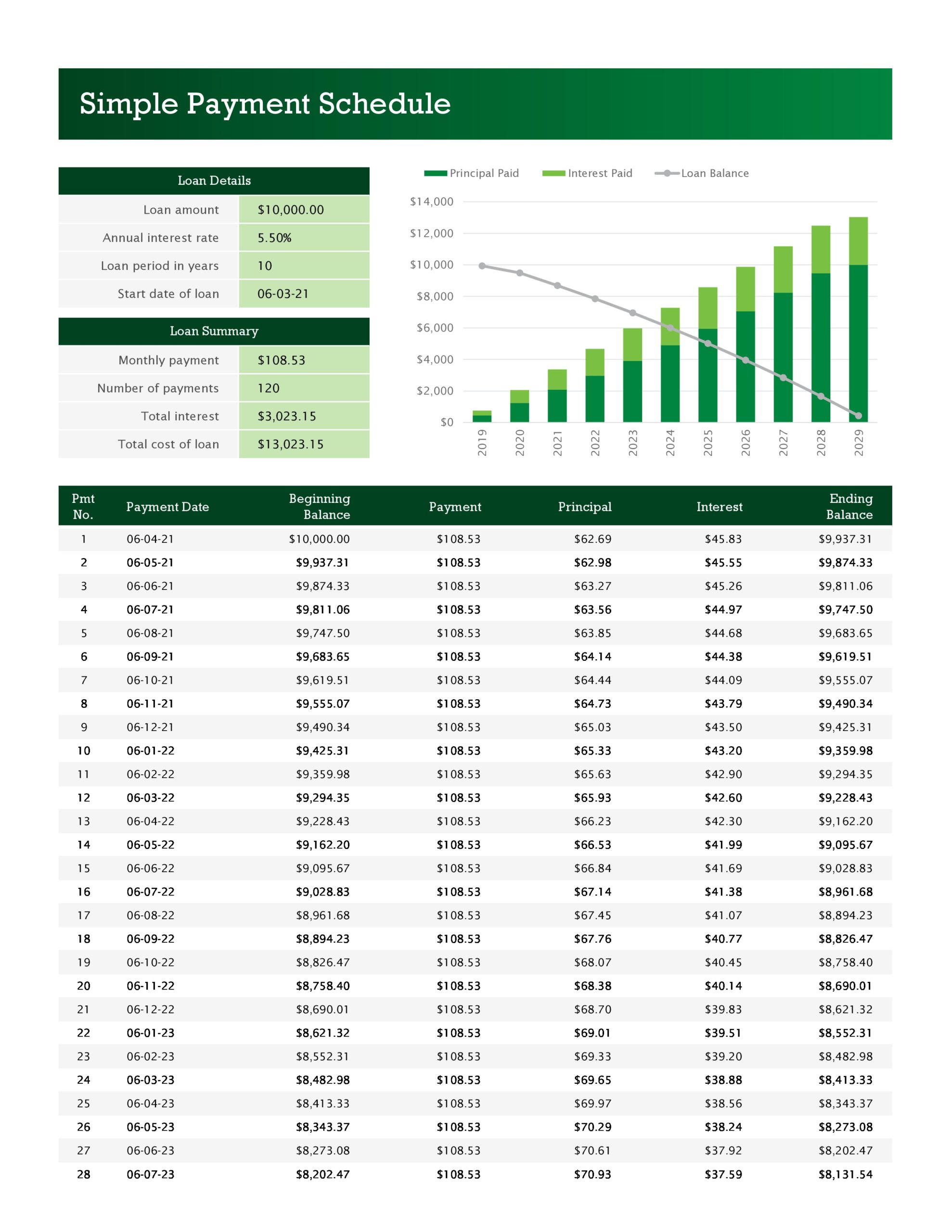

step three. Brand new 15- and you can 20- year title and you may Flat Percentage Fees option (expenses $25 per month throughout the from inside the-college deferment) are only readily available for mortgage degrees of $5,000 or higher. And come up with appeal only or apartment interest payments during deferment doesn’t reduce the prominent harmony of one’s mortgage. Fee examples (all the imagine an effective 14-month deferment period, a half a dozen-week grace months in advance of typing payment, no automobile spend dismiss, therefore the Interest Simply Cost solution): 5-12 months identity: $10,000 mortgage, you to definitely disbursement, that have a great 5-12 months repayment title (60 weeks) and a nine.60% Annual percentage rate create end up in a monthly principal and you can desire commission out of $. 7-seasons name: $ten,000 loan, that disbursement, with a great eight-seasons cost label (84 weeks) and you can a beneficial 8.82% Annual percentage rate do result in a month-to-month dominating and you can attract commission away from $. 10-year title: $10,000 loan, you to disbursement, that have a 10-year fees title (120 days) and you will good 8.57% Annual percentage rate create lead to a month-to-month prominent and you can attract payment off $. 15-12 months label: $10,000 loan, one disbursement, which have, a good fifteen-12 months repayment identity (180 weeks) and you will an excellent 8.48% Apr do bring about a monthly dominating and you may desire commission away from $. 20-year label: $10,000 loan, you to disbursement, with, a great 20-seasons installment name (240 weeks) and you can an effective 8.62% Apr would end in a monthly principal and you may appeal payment of $.

cuatro. Individuals that have Appeal Merely otherwise Apartment Fee financing you to definitely come to at the minimum 120 days outstanding through the an in-college or university deferment months will automatically has its payment solution transitioned of the eye Simply or Apartment Payment fees choice to the full Deferment payment option. 00%). Getting an apartment Commission loan, the rate will increase by one-quarter of one percentage section (0.25%). One outstanding accumulated notice at the end of a call at-university deferment months may be capitalized according to the Borrowing Contract.

Around these situations, the rate for the financing have a tendency to instantly improve to fit the interest rate on the related Full Deferment loan

An Abe SM education loan was a private student loan, often referred to as a gap mortgage. Exactly why is it named a gap financing? Due to the fact personal figuratively speaking can also be complete the fresh new gap ranging from all of their almost every other college funding information while the total price of going to school.

To have an interest Merely financing https://www.clickcashadvance.com/loans/online-personal-loans-with-co-signer/, the pace increase because of the that fee section (1

To determine exactly how much you need, sound right all your almost every other college or university funding quantity out of federal scholar and moms and dad loans, scholarships and grants, grants, college or university financial aid bundles, and you can university deals preparations. Deduct the entire out of your full yearly cost of university fees, room and panel, supplies, and you will expenses – that’s how much cash you can request out-of Abe so you can fill new pit. step one

Abe allows you to acquire only $step one,000 otherwise as much as $99,999 per mortgage. If needed, you could potentially pull out more than one financing. Provided their overall level of all of the student education loans will not meet or exceed $225,000, you are good.

Ascent even offers experts one to place college students very first: Timely & Effortless Software Look at your pre-licensed cost within a few minutes in the place of affecting your credit score Versatile Payment Alternatives Personalize the loan to fit your need 1% Cash back Graduation Reward Receiver receive typically $360! step 1 Monthly No-Article Scholarships and grants Find Ascent Scholarships and grants having parents and you may college students 14+ entitled to implement! Save money Rating an excellent 0.25% 1.00% autopay write off dos Non-Cosigned and you may Cosigned Loan Solutions Boost your acceptance chances of the doing 4x 3 when you implement that have an effective cosigner Availability AscentUP’s entertaining college or university information to boost your financial, academic, and job triumph 4 Timely 12-Day cosigner release solution 5 Down load new AscentConnect app 6 to deal with your loan repayments, get monetary wellness information, and check what you owe everything in one set.